Daily Systematic Signals

Start free with SPY. Upgrade for multi-asset access + LimitMatrix ensemble (with high-conviction flag).

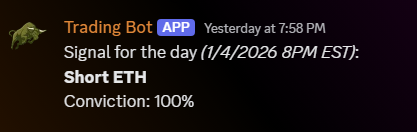

Each post includes: Long/Short/Cash,

Conviction %, and a chart snapshot.

Equities and metals post at 4PM EST.

Crypto posts at 8PM EST.

How it works

Simple flow: join, review, upgrade if you want more coverage.

Get free SPY access to 4 core strategies and the daily posting format.

See signal state, conviction, and visuals posted inside the channels.

Pick individual signals or the All Signals plan for full coverage plus LimitMatrix.

Examples

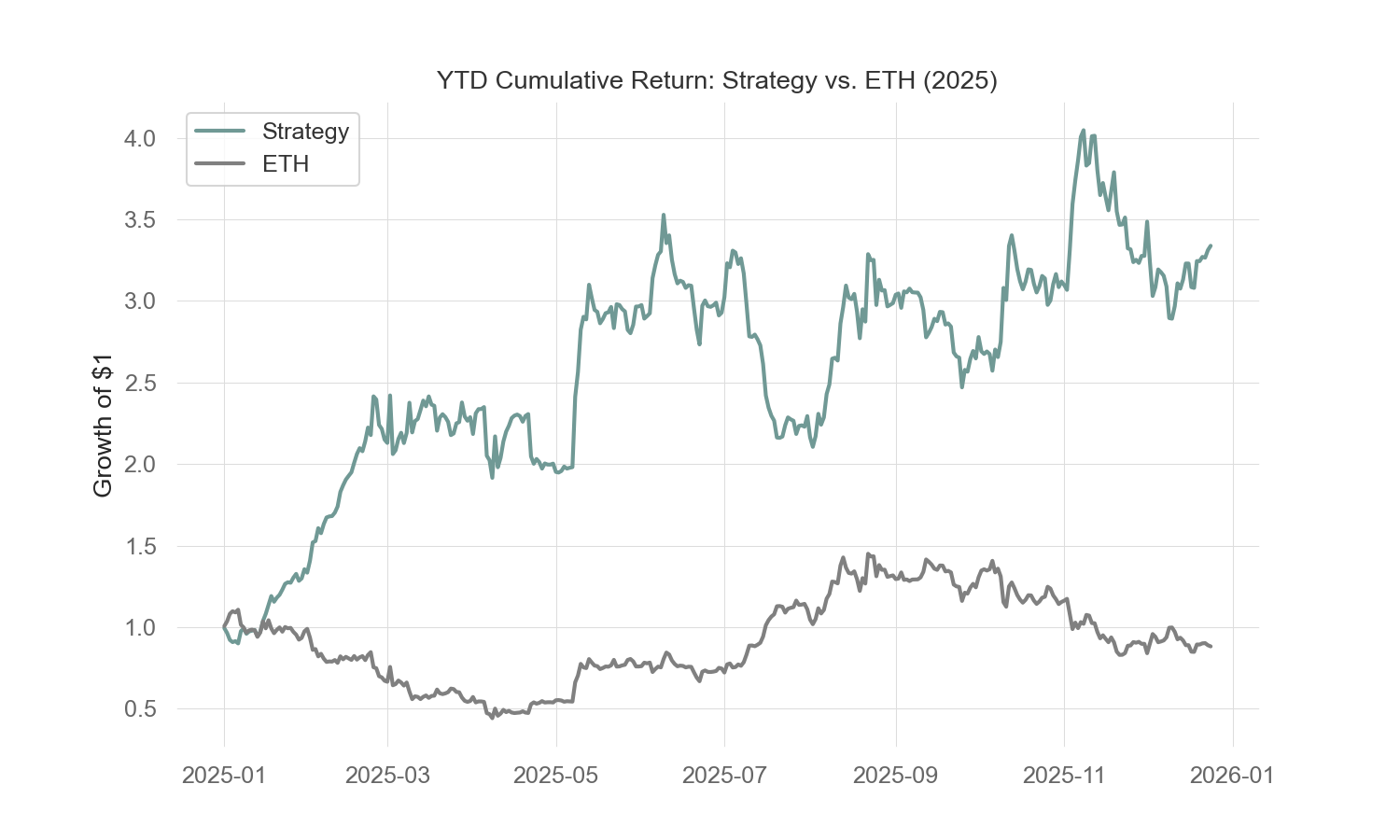

Signal example and performance chart example from the server.

Strategies

Each strategy targets different market behavior. LimitMatrix blends them into a per-asset decision layer.

DualPulse

AvailableMedium-to-long-term trend signal built to capture sustained moves while reducing drawdowns.

Best in: sustained directional markets

ApexFlux

AvailableLower-frequency, higher-selectivity signal designed to trade less often and prioritize cleaner setups.

Best in: higher quality directional setups

QuantumVol

AvailableVolatility-adaptive signal designed for choppier regimes and volatility expansion.

Best in: choppy or high-vol regimes

BarDelta

AvailableBar-to-bar price action signal that shines in strong momentum bursts and relief bounces; weaker in slow grind-ups.

Best in: fast momentum, relief bounces

LimitMatrix (Ensemble Decision Layer)

All Signals onlyEnsemble decision layer that blends signals using weighting, stability, and regime fit. Not simple vote-counting. Includes a high-conviction flag only when conviction is unusually strong and internal risk filters are met. The flag can indicate 2x exposure for those who choose to use it.

High-conviction flag: LimitMatrix only

Pricing

Free SPY preview, individual signals, or the full suite. Performance channels remain visible to all members for transparency.

Free Tier (SPY)

Daily SPY signals for all core strategies.

- ✓SPY daily signals for 4 strategies

- ✓Performance channels visible

- ✓Posting schedule: Equities and metals: 4PM EST • Crypto: 8PM EST

- ✓No LimitMatrix

Individual Signals

Pick the strategies you want.

$24.99

USD / month (per strategy)

- ✓Choose any of: DualPulse, ApexFlux, QuantumVol, BarDelta

- ✓One strategy unlocks all its asset channels: SPY, QQQ, GLD, SLV, BTC, ETH

- ✓Posting schedule: Equities and metals: 4PM EST • Crypto: 8PM EST

- ✓No high-conviction flag

All Signals

Full coverage plus LimitMatrix.

$99.99

USD / month

- ✓All strategies across assets: SPY, QQQ, GLD, SLV, BTC, ETH

- ✓LimitMatrix ensemble per asset

- ✓High-conviction flag only for LimitMatrix

- ✓Posting schedule: Equities and metals: 4PM EST • Crypto: 8PM EST

FAQ

Short answers to typical questions.

Risk disclosure

Read this before joining or upgrading.

Important: Trading involves risk of loss, including loss of principal. Signals are for informational and educational purposes only and are not investment advice or a solicitation to buy or sell any security.

Any pre-launch performance is hypothetical backtested. Backtests use historical data and model assumptions. Past performance does not guarantee or indicate future results.

Backtests and live results can differ due to fees, slippage, execution delays, and market conditions.